Overview:

This episode examines how the growing frequency and intensity of natural disasters in 2025 are pushing the U.S. insurance system to its limits. The hosts highlight alarming data—from 43,000 wildfires and record tornado counts to catastrophic floods like the Texas Hill Country event—and explain how these escalating losses are driving a widening insurance gap. Insurers are retreating from high-risk regions, premiums are soaring, and many homeowners are dangerously underinsured. The episode offers three key action steps: (1) update your coverage limits to reflect today’s rebuilding costs, (2) assess your real local risks and add flood or wildfire protection even if not required, and (3) document your property thoroughly before disaster strikes. The takeaway: natural disasters are accelerating faster than the insurance system can adapt, and homeowners must act now to stay financially protected.

Get Quotes Before Renewing Your Policy Automatically

Insurance Policies and Premiums are changing constantly every year.

Before accepting another automatic renewal, use the unlimited quotes My Policy Advocate offers to shop for the policy that reduces your risk of a claim denial and provides the choices you want.

The frequency and cost of natural disasters are increasing, a trend confirmed by federal data. As the nation progresses through 2025, a clear and costly picture of weather and climate disasters is already taking shape.

The National Perspective in 2025. While 2024 was a historic year for costly disasters, 2025 has already seen significant and deadly events. A notable change this year is that NOAA’s National Centers for Environmental Information (NCEI) ceased updating its widely-cited “Billion-Dollar Weather and Climate Disasters” database in May 2025. However, the trend of costly and frequent disasters has demonstrably continued.

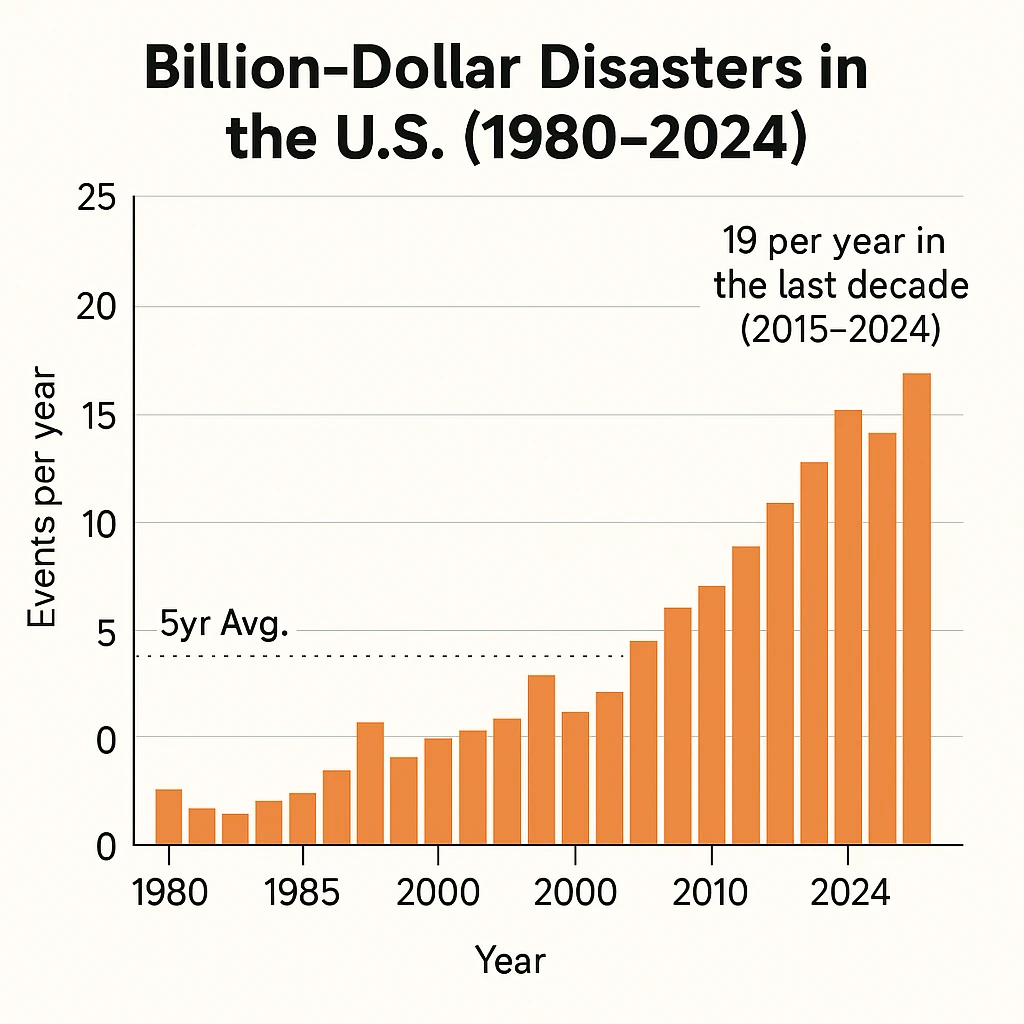

The archived data from 1980 through 2024 tells a story of rapid escalation. Over those 45 years, the U.S. experienced 403 billion-dollar disasters.

The average number of these events grew from about three per year in the 1980s to 19 per year in the last decade (2015-2024).

Disaster Breakdown: 2025 Events

Wildfires According to the National Interagency Fire Center (NIFC), as of mid-August 2025, there have been 43,832 wildfires reported nationally, burning a total of 3.8 million acres. This indicates a more destructive fire season in terms of acreage compared to the previous year. Currently, 49 large fires are actively burning across nine states, engaging nearly 20,000 personnel.

Hurricanes The 2025 Atlantic hurricane season is predicted to be above-normal. In an update issued in early August, NOAA forecast a range of 13 to 18 named storms, with 5 to 9 of those expected to become hurricanes, and 2 to 5 potentially strengthening into major hurricanes. This continues the recent trend of more active and intense storm seasons.

A notable event so far in 2025 was Tropical Storm Chantal, which made landfall in the Carolinas over the Independence Day holiday weekend, bringing high winds and deadly flooding to the region.

Tornadoes Tornado activity in 2025 has been significantly above average. As of the end of June, NOAA recorded a preliminary count of 1,394 tornadoes, which, if confirmed, would be the fourth-highest count on record for the first half of the year. These severe weather events have tragically resulted in at least 35 fatalities so far in 2025. States across the central and southern U.S. have experienced severe outbreaks, including powerful EF3 and EF4 tornadoes.

Flooding and Severe Storms Catastrophic flooding has been a major story in 2025. In early July, devastating flash floods in the Texas Hill Country resulted in at least 135 fatalities, making it one of the deadliest inland flooding events in the U.S. in decades. The event was fueled by extreme rainfall that saw the Guadalupe River rise about 26 feet in just 45 minutes. This single event’s death toll has already approached the total number of widespread flood-related fatalities for all of 2024.

This underscores a critical issue: the insurance gap. Flood damage is not covered by standard homeowner’s policies and requires separate coverage, which only a small percentage of homeowners carry.

The Widening Insurance Gap

The escalating risk from natural disasters is putting immense strain on the insurance market, leaving many Americans dangerously exposed.

Key Insurance Challenges:

Flood Insurance Exclusion: Standard homeowner’s policies do not cover flood damage. This crucial protection must be bought separately, often through FEMA’s National Flood Insurance Program (NFIP), yet very few homeowners have it.

Insurers in Retreat: Faced with mounting losses, major insurance companies are limiting their exposure in high-risk states like California, Florida, and Louisiana. This includes pausing new policies or not renewing existing ones in areas prone to wildfires and hurricanes.

Soaring Premiums: For those who can obtain coverage, premiums are rising sharply. In the highest-risk regions, homeowners have seen double-digit percentage increases year-over-year, making insurance unaffordable for many.

The Risk of Underinsurance: Even with a policy, homeowners may be underinsured. Rapidly rising construction costs mean that coverage limits that were adequate a few years ago may no longer be sufficient to fully rebuild after a total loss.

Outlook and Recommendations

The data confirms that the financial and human risks from natural disasters are escalating. As the insurance market adapts to this reality, homeowners face significant challenges.

To protect yourself, it is critical to:

Review your policy annually to ensure your coverage is in line with current rebuilding costs.

Understand your specific risks and purchase separate policies for perils like flooding if you are exposed.

Document your property with a detailed inventory, including photos and videos, to simplify any potential future claims process.

References:

The National Picture: Frequency and Cost of Disasters

- U.S. Billion-Dollar Weather and Climate Disasters (1980–2024) – NOAA NCEIThe definitive dataset on America’s costliest disasters.NOAA confirms 403 events from 1980–2024, totaling >$2.7 trillion in damages, and notes that the dataset was retired in May 2025.

- Notice of Changes: Retirement of the “Billion-Dollar Disasters” Product – NOAA NESDIS (2025)Official NOAA announcement confirming discontinuation of updates beyond 2024.

- U.S. Billion-Dollar Weather and Climate Disasters Dataset (Archived 1980–2024) – Data.gov CatalogPermanent archival entry describing the scope, methodology, and metadata of NOAA’s 1980–2024 record.

- Billion-Dollar Disasters 2025 – Climate CentralIndependent research analysis summarizing NOAA’s final 2024 data and showing that tropical cyclones = 53% of total costs and severe storms = most frequent events.

Wildfires: Escalating Acres and Costs

- Fire Information and Statistics – National Interagency Fire Center (NIFC)Live federal data feed on 2025 fire counts, acres burned, and historical comparisons.As of October 2025 → 54,615 fires / 435,613 acres burned on large fires.

- U.S. Wildfires 2025 – Center for Disaster PhilanthropyTrusted nonprofit summary compiling federal NIFC data.As of Aug 2025 → ≈ 3.99 million acres burned / 44,470 fires nationwide.

- Climate Change Indicators: Wildfires – U.S. Environmental Protection Agency (EPA)Federal long-term trend analysis.Since 1983, the U.S. has averaged ≈ 70,000 wildfires per year, with a clear upward trend in acres burned.

Storms, Flooding, and Tornado Activity

- National Centers for Environmental Information (NCEI) – Severe Storms and Tornadoes SummaryPreliminary tornado data: 1,394 events through June 2025, on track for one of the most active years on record.

Academic & Policy Research on Insurance and Disaster Economics

- Spatial Disparities in Fire Shelter Accessibility (2025) – arXiv PreprintAcademic modeling of wildfire displacement and emergency-response inequities during the 2025 fire season.

- Climate Risk and Insurance: Policy Lessons from Three Regions – PNAS (2024)Peer-reviewed analysis of how governments and insurers adapt to escalating climate risk and underinsurance.

- Enhancing the Insurance Sector’s Contribution to Climate Adaptation – OECD (2023)Global economic study showing how “green” incentives and risk-based pricing can improve resilience