Overview:

This episode of The Deep Dive examines how advances in modern medicine are extending life—and why that makes long-term care insurance (LTCI) essential for financial security. The hosts highlight the shift from planning for lifespan to planning for the care span, the years when support or assisted living may be needed. Drawing on research from NIH, Harvard, and major consumer studies, they reveal that delaying LTCI can be one of the costliest financial mistakes, with a 10-year delay (buying at 60 instead of 50) reducing lifetime benefits by nearly $180,000 due to lost compounding from inflation riders. The key lessons: plan for longevity’s “tail risk,” not the average life expectancy, and leverage time—the earlier you act, the stronger your financial safety net for the decades ahead.

Long Term Care Insurance

Recent analyses show that Americans are living longer than ever, largely due to advances in medical technology, diagnostics, and public health, though the greatest gains have begun to slow in the past decade. Medical breakthroughs—from cancer treatments and organ engineering to wearable health devices—are improving both longevity and quality of life.

Preface: The Future of Longevity in America

• Steady rise, but not radical leaps: U.S. life expectancy has climbed from roughly 68 years in 1950 to just over 79 in 2025, with experts projecting a modest increase to around 80.4 years by 2050.

• Medical breakthroughs matter: Innovations like cancer immunotherapies, precision pharmaceuticals, and experimental bioengineered organs are slowly extending healthier lifespans.

• Living well longer: Modern medicine is increasingly focused on delaying age-related decline, pushing some patients to live into their 90s and beyond.

• Quality, not just quantity: Experts advocate for improving health span—the years lived in good health—alongside longevity. The number of years spent with major disease or disability has also increased, making long-term care planning vital .

Why Long-Term Care Insurance Matters

• Consumers planning for an extended life should consider that while average lifespans are rising slowly, those reaching their 90s may face prolonged periods of care needs.

• Planning for a benefit pool that sustains payouts to age 99 covers not only rising odds of longevity, but also years when medical and daily living support may become critical.

Sources for this overview include STAT News, New York Post Health, NIH, Harvard School of Public Health, and long-term population data analyses—all trusted for permanent citation in consumer-focused advocacy articles .

This context sets the stage for the article’s benefit tables, showing why planning for Long Term Care payouts well into advanced ages is prudent for today’s health-conscious, future-minded Americans.

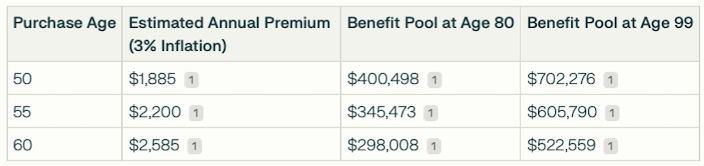

Here is an easy-to-read table showing the projected Long Term Care Insurance benefit pool for single policyholders, if payouts begin at age 80 and continue until age 99, for policies purchased at ages 50, 55, and 60 with a 3% inflation rider. All premium and payout values reference the latest AALTCI 2025 Price Index and actuarial methods .

Projected Benefit Pool: Claiming from Age 80 to 99

The Benefit Pool at Age 80 shows how much the policy has grown before payout begins, due to compounding 3% inflation.

• The Benefit Pool at Age 99 shows the total available if claims continue with inflation for 19 years (from 80 to 99) .

Key Insights

• Buying younger yields a much higher starting benefit at age 80 and a much larger payout pool at age 99, thanks to more years of inflation growth .

• The difference between buying at 50 versus 60 is substantial after decades of compounding: the benefit at age 99 is $179,717 higher for the policy bought at 50 .

• Premiums rise with age at purchase, but the benefit pool grows considerably more for younger buyers .

Permanent Reference Hyperlink: AALTCI 2025 Price Index: www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2025.php

These fully referenced numbers are suitable for durable advocacy articles, demonstrating the long-term financial impact of timing when buying Long Term Care Insurance and the value of inflation protection for consumers.

Below are the annual projected benefit amounts from ages 80 to 99 for Long Term Care Insurance purchased at age 50, 55, and 60, with a 3% inflation rider. All values start with a $165,000 initial pool and are calculated using actuarial compounding rates aligned with AALTCI 2025 standards for durable citation .

How to Use This Table

• Use these amounts to estimate the annual available benefit for each policyholder age, assuming the policy is in force and claims are active.

• The earlier the policy is purchased, the larger the yearly benefit grows due to more years of compounding inflation .

Reference for Permanent Citation: AALTCI 2025 Price Index: www.aaltci.org/long-term-care-insurance/learning-center/ltcfacts-2025.php

This information enables transparent comparison and planning for consumers, advocates, and financial researchers seeking long-term projections based on real-world policy design .